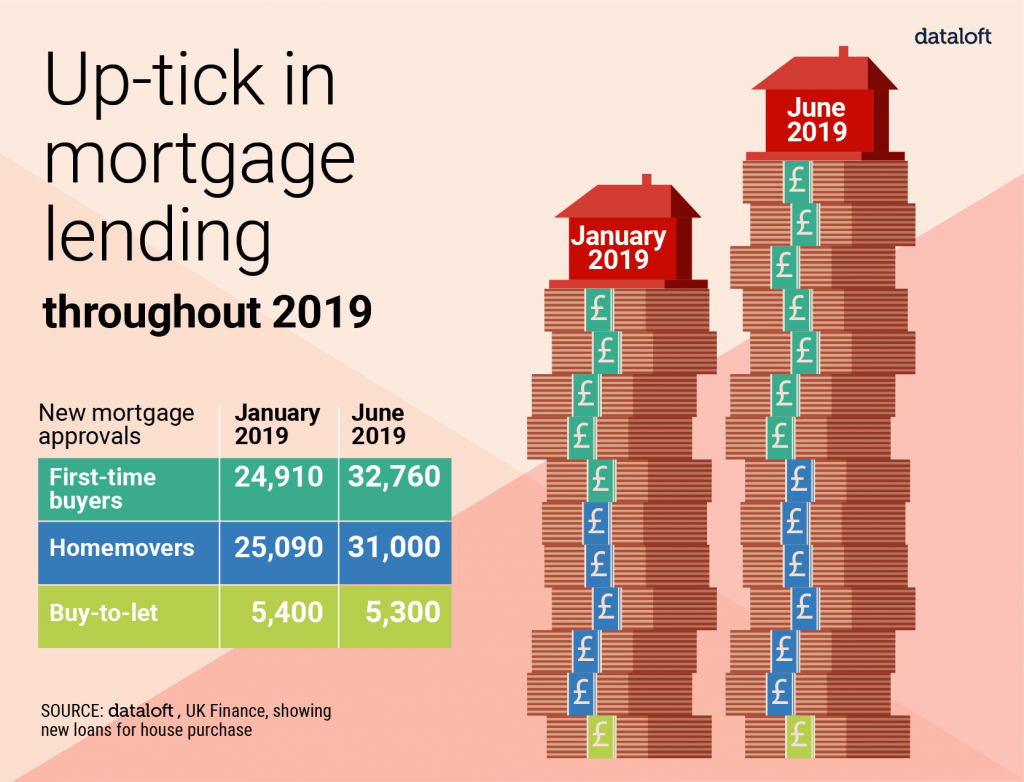

In June, there were just under 70,000 new mortgage approvals according to UK Finance, which is 5% higher than the level reported in May.

Loans to first-time buyers (comprising 47% of approvals) were once again greater than those to existing homeowners (45% of approvals). First-time buyer loans rose by 6.2% in the month.

Lending to buy-to-let investors has remained fairly consistent over 2019, comprising just 8% of approvals in June.

While the level of mortgage lending has been on a generally upward track over 2019, figures for June 2019 remain below those recorded the year previously, in June 2018.

Approvals to first-time buyers were down 1.5%, to homeowners they were down 3.5% and there has been a 3.6% fall in approvals for buy-to-let investors.

Here at Edward Mellor, we offer over 50 of the latest rates from niche and high street lenders to find a mortgage deal that’s right for you.

We have a friendly team of highly qualified mortgage experts ready to offer you choices, options and solutions when it comes to funding your home.

From finding you the perfect mortgage rate, right the way through to the paperwork, our team handles every aspect of the process.

If you’d like a free, friendly chat with our team, click here.

Martin Lewis urges first-time buyers to open a help-to-buy ISA now